![]()

Around 31% of American adults say they’re relying on an auto loan to pay for a car in 2022, with a further 14% saying they plan on getting an auto loan in the first half of 2023.

One of the top 4 frustrations in car buying is understanding finance

With rising interest rates and the increased value of vehicles, crossing both new and used, this shows signs of consumers wanting to keep their vehicles in top notch condition for longer. Rising monthly payments mean customers do not want to spend more on large repair bills. And, with so many financial programs on offer. Where does the consumer start?

From a customer’s perspective they have spent over 8 hours online searching for their perfect vehicle, more time visiting the dealership choosing, considering, confirming. And that, may not include any website build. So, does the consumer want to come into the dealership at a time that may not be convenient to discuss which finance options work for them? Will all parties be available to travel to the dealership for the same reason? There is a better way!

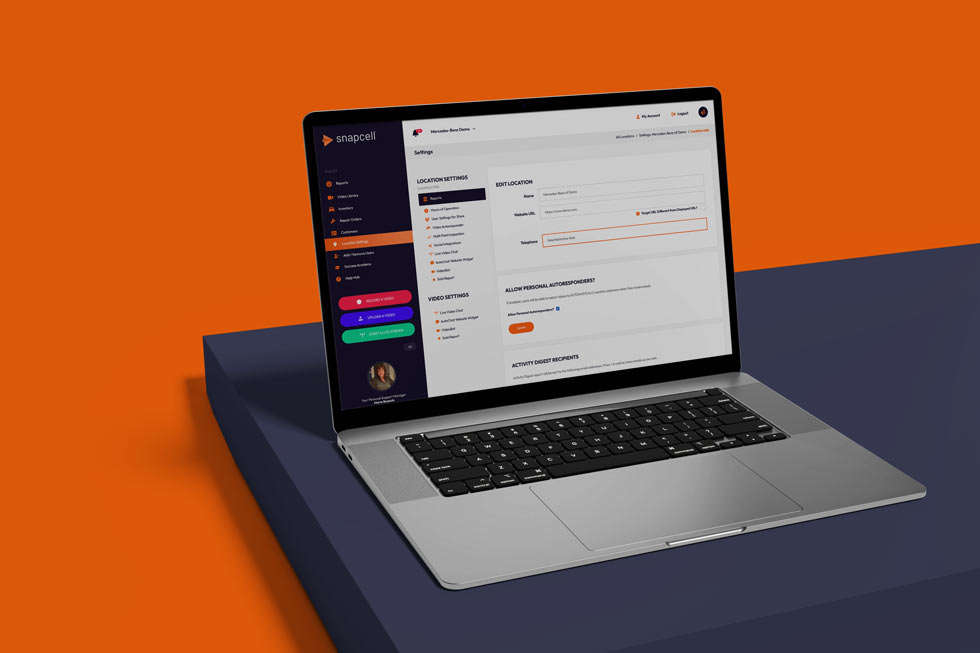

With an F&I / Snapcell partnership you will be able to take advantage of not just interactive video communication with extensive reporting.

You can create in screen recordings guiding the customer through each program, show them any websites to visit for accuracy, remind them of next steps with an easy approach.

You can livestream a customer, either via mobile or desktop. Accessing a live face to face conversation enables the customer to invite other relevant parties on the call and with NO customer downloads.

Our professional templates are built with your dealership in mind so the customer trust continues.

Save time, for yourself and your customer and book a demo today!